Economists nationwide believe there will be at least two cash-rate cuts in the latter half of 2024, but will that be enough to help renters finally enter the property market?

The latest Domain Rent Report has revealed rent prices have finally stalled after nearly three years of continuous quarterly increases. For renters keen to get on the property ladder, this news, as well as forecasts predicting rate cuts later this year have sparked a glimmer of hope that things could get a little easier this year – because when the cash rate moves banks tend to move their interest rates in the same direction.

Ray White Group chief economist Nerida Conisbee says a lower cash rate could improve mortgage affordability, allowing first-time buyers to borrow more, or have lower mortgage repayments.

Mozo finance expert Rachel Wastell says even a couple of interest rate cuts could make a material difference to hopeful home buyers.

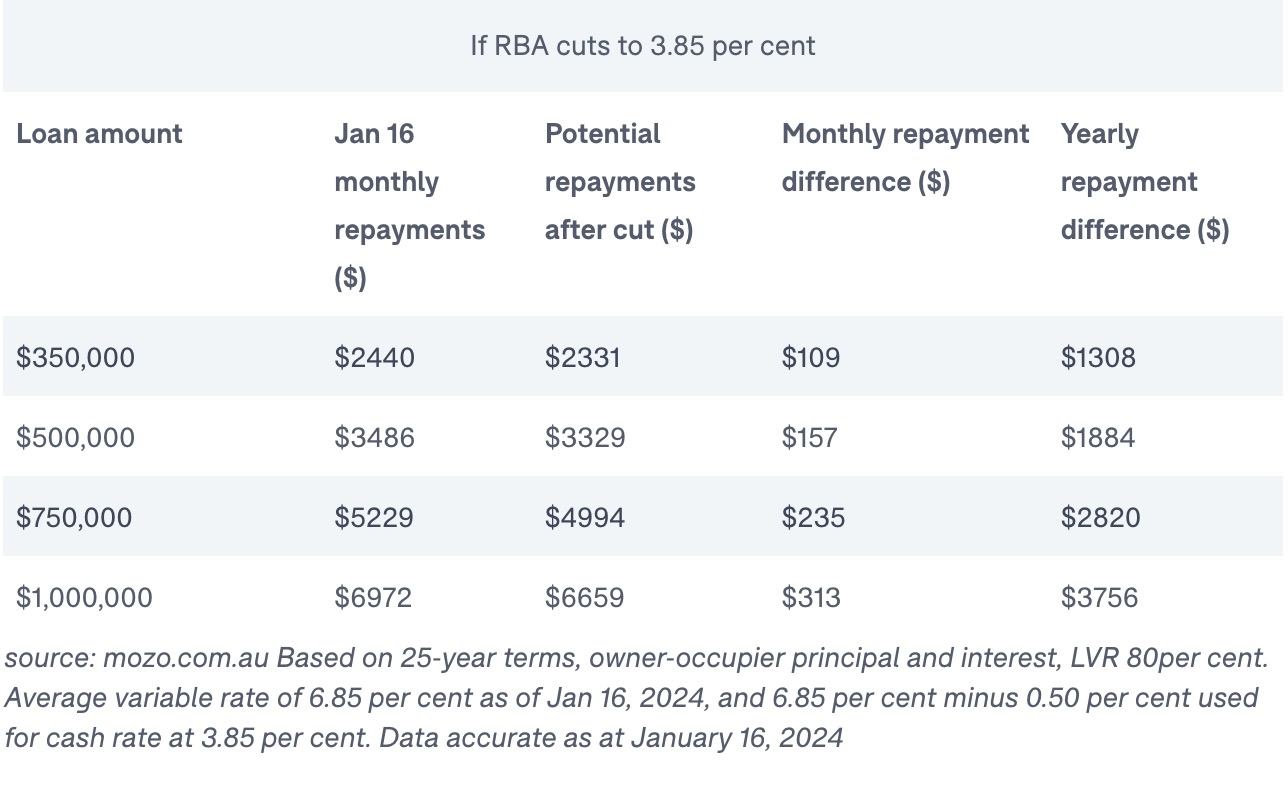

“Mozo data indicates that a 0.50 per cent rate cut by the RBA would take the cash rate to 3.85 per cent and potentially save home owners with a $500,000 property $157 per month, or $1884 annually if they pass it on in full,” she says.

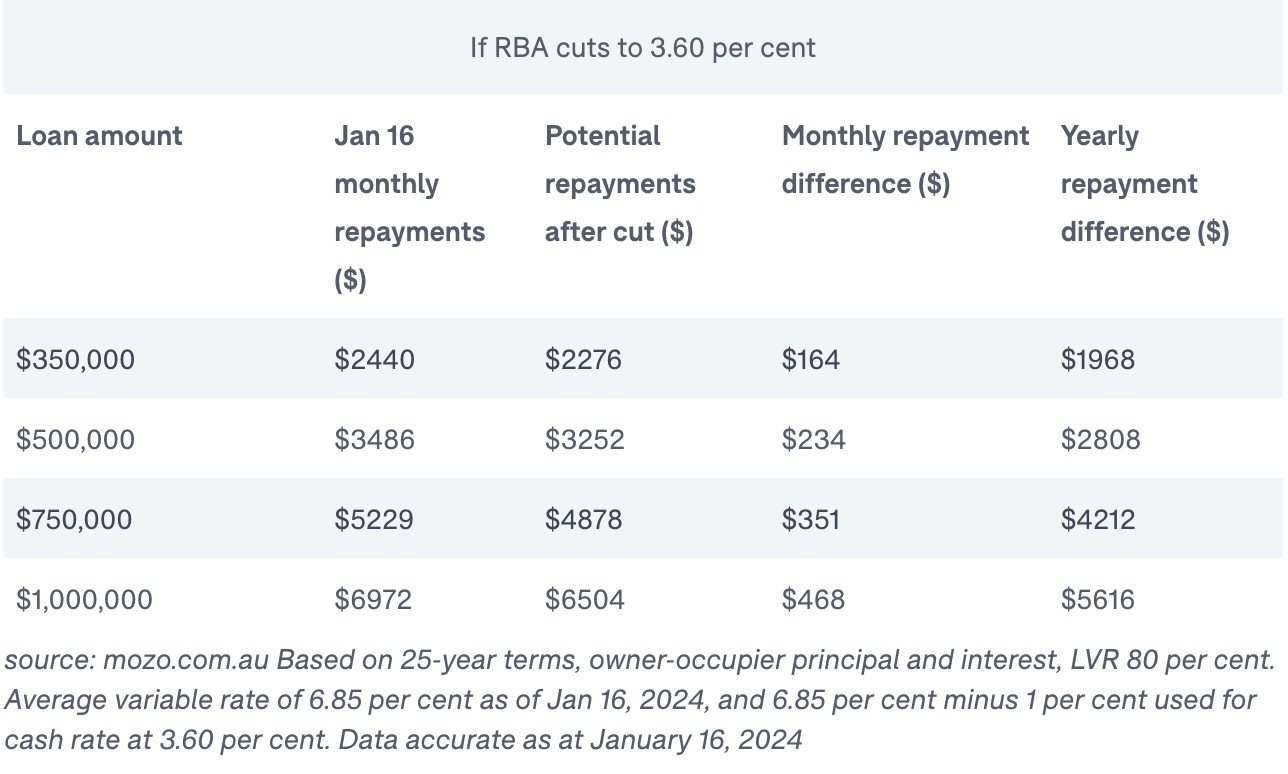

“A cut of 1 per cent, If the RBA reduces the cash rate to 3.60 per cent and banks reduce variable rates by the full 75 basis points, could see home owners with a $500,000 property save $234 a month or $2808 a year,” Wastell says.

In the past, banks have taken several days or weeks to pass on the rate change after a new announcement. While it’s likely the banks will follow similar patterns when a cut is announced, the savings are made once those cuts are in place, she says.

Generally, lower rates would ease some of the past financial pressures home owners and renters have experienced in the last few years, Connisbee says, creating a more positive sentiment and market outlook overall.

A lower-stress market for home owners could also have a positive impact on the rental market, she adds.

“If we see rate cuts and we see more homes being built, then ideally, we’d start to see rents come down too,” she says.A lower rate could also entice investors back into the market, says Domain chief of research and economics Dr Nicola Powell.

“You tend to find investors are sparked by capital growth and as 2023 unravelled [and prices went up], we started to see more investors come back into the market,” she says.

With more investors in the market, rental supply and vacancy rates could increase, allowing the potential for a further slowdown in rental prices and allowing tenants to save more towards their own place in the long term.

However, some economists think it’s a bit too early to celebrate the prospect of potential rate cuts leading to better affordability for owners and renters.

Sean Langcake, head of macroeconomic forecasting at BIS Oxford Economics, says a lower cash rate could help people, but the biggest hurdle is still saving up for the deposit.

“Property prices have had a hell of a run over the last couple of years, and the deposit that you need based on the share of most families’ income is extremely high,” he says.

Moreover, a cut to interest rates could further accelerate buyer demand, pushing prices up and making housing more expensive.

Australia’s property market is notoriously resilient. Last year’s market defied expectations when prices kept rising, despite the steepest run of interest rate rises seen in decades.

“We’re expecting now probably stronger rates of growth into the later part of this year and early in 2025,” Powell says.

Despite the expectation of price growth, she says the improvement of borrowing capacity is a game-changer as it will help people access the market, especially when utilising the new first-home buyer incentives rolling out this year.

“Regardless of whether rate cuts are, in fact, on the horizon for 2024, it’s important that home owners [and current renters] don’t count their chickens before they hatch,” Wastell says.

Sourced from Domain.com.au

in Latest News

Share This Post

Categories

Archived Posts

- February 2024 (1)

- January 2024 (2)

- October 2023 (2)

- September 2023 (1)

- August 2023 (3)

- July 2023 (2)

- September 2021 (1)

- August 2021 (3)

- November 2019 (1)

- October 2019 (4)

- February 2018 (1)

- January 2018 (1)

- December 2017 (3)

- November 2017 (1)

- October 2017 (2)

- September 2017 (4)

- August 2017 (4)

- July 2017 (2)

- June 2017 (1)

- May 2017 (1)

- April 2017 (1)

- March 2017 (1)

- February 2017 (1)

- January 2017 (2)

- December 2016 (2)

- November 2016 (1)

- September 2016 (1)

- July 2016 (1)