The number of people putting their homes on the market because they can’t afford their mortgage repayments is actually falling, despite cost pressures from rising interest rates and inflation, the latest data reveals.

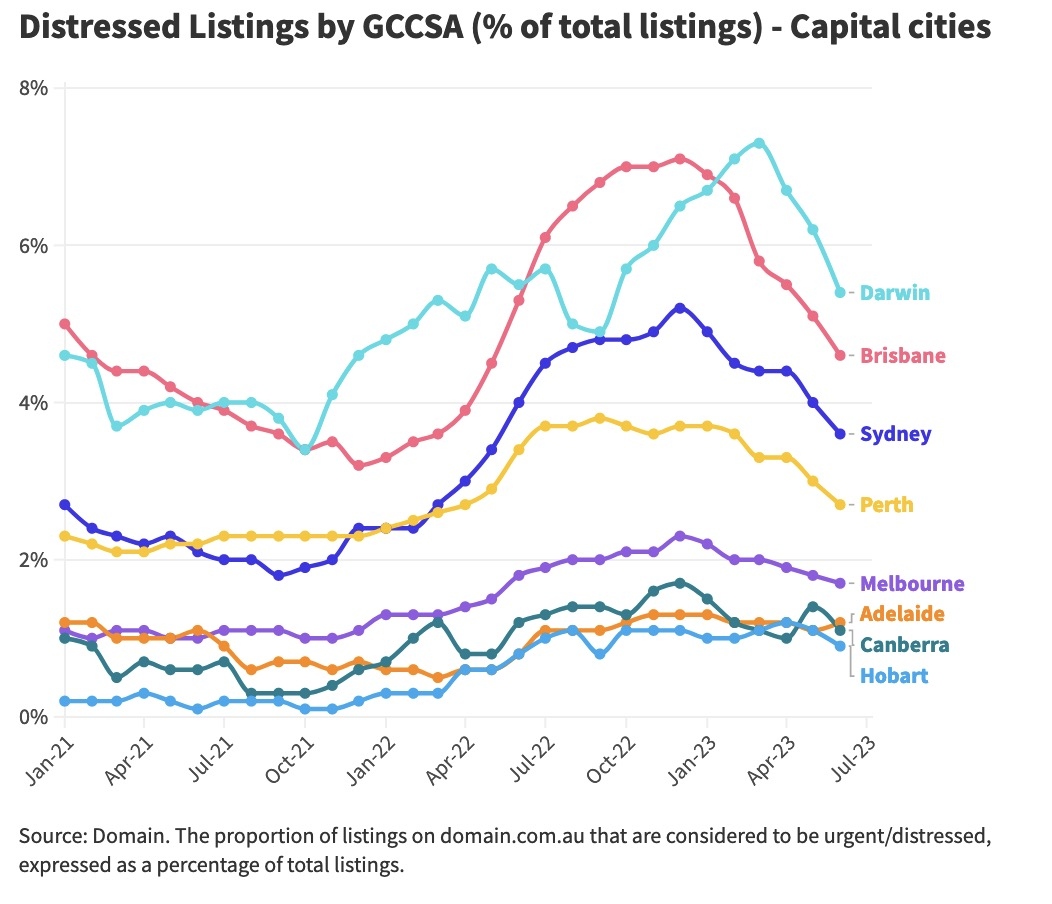

The surprise figures, contained in a Domain report that charted the numbers of distressed listings in each capital city from January 2021 to June 2023, show widespread declines, although some suburbs are still hurting.

In Sydney, only 3.6 per cent of listings were a result of financial pressures in June 2023, compared to the December 2022 high of 5.2 per cent.

In Melbourne it was 1.7 per cent as against 2.3 per cent six months ago, in Brisbane 4.6 per cent, down from 7.1 per cent, and in Canberra, down to 1.1 per cent from 1.7 per cent.

In Hobart, the figure was 0.9 per cent, down from its high of 1.2 per cent in April 2023, and in Darwin, 5.4 per cent, down from 7.3 per cent in March 2023.

Adelaide’s distressed listings increased slightly between May to June – from 1.1 per cent to 1.2 per cent – but the figure is still down from its peak level of distressed listings (1.3 per cent) late last year.

Within those distressed property sales, however, Queensland is doing it the toughest – largely because of all the Sydneysiders and Melburnians who flooded to the state during and post-COVID to buy holiday homes and investments.

Slugged by 13 months of interest-rate rises, and with rents still not high enough to compensate, many are now trying to offload their houses and apartments before they lose any more money.

“I’ve had a lot of investors cashing in now because their repayments on properties have gone up so dramatically,” said Matt Micallef of Ray White Robina.

“There was also a lot of FOMO [fear of missing out] generated by all the interstate buyers coming in, and everyone locked in mortgages at 2 per cent.

“But now they’re all finding they’re really overstretched. We’ve listed 15 properties this month, and nine are investors. None of them were expecting interest rates to rise so steeply and so quickly.”

New Domain data has found that eight of the 10 regions in the country with the most distressed listings are in Queensland, mostly around Brisbane’s south-east and east, and on the Gold Coast.

Only two regions in other states made it into that dismal top 10: Barkly in the Northern Territory, with its main town, Tennant Creek, at number one, and Fairfield in Sydney’s west in ninth place.

In Barkly, the Domain report found, 15.6 per cent of listings in June 2023 were by distressed sellers – people who want to sell properties urgently usually because of financial pressures. That’s a figure 2.4 per cent up on the past year.

Most of those were likely to be investors, said Jo-Anne Pulsford of Nutrien Harcourts Alice Springs, who sells in Tennant Creek, because a huge chunk of the homes in Tennant Creek had owners who leased properties to Territory government employees, like police officers, corrections officials and health and education workers.

“A majority of our purchasers are investors, with very few people in the last three to four years buying places to live in,” she said.

“A lot of people also used their super funds to buy investment property here and it could be that some, with the interest rate increases, have found they’re over-committed.”

The next seven places on the table are all in Queensland, with Brisbane’s Sunnybank leading the way with distressed listings at 13 per cent, although that figure was at the same level last year.

Gary Liu of LJ Hooker Property Partners, who operates in the area, said it had a high percentage of Asian buyers but many of those bought with cash and so were unaffected by interest rate hikes.

“But interstate activity has been very very high here, and that’s been driving up prices,” he said.

“That means some people who paid top prices on mortgages are now suffering from having much bigger mortgage repayments on large sums of money.”

Wynnum-Manly in Brisbane’s eastern suburbs had the next-highest proportion of distressed listings at 12 per cent – down 2.4 per cent over the year.

That was still a worrying figure, said Chris Vote of Raine & Horne Wynnum Manly, and it was likely to increase as more people faced the fixed-mortgage-rate cliff.

“That means paying out tens of thousands of dollars more each month,” Vote said. “I’ve got one investment property coming up for auction where the rent just won’t cover the extra interest payments, and the tenants may be on a fixed 12-month term so the owner can’t increase the rent to help fill the gap.”

During the pandemic, many owners of properties closer to the city, such as in Camp Hill and Norman Park, also sold to buyers from Sydney and Melbourne and then moved to more expensive homes on the bayside for lifestyle and to work from home.

“They bought as the prices went up and serviceability wasn’t taken into consideration,” he said.

Other hard-hit areas include Mudgeeraba-Tallebudgera on the Gold Coast, where 11.9 per cent of listings are distressed, the Gold Coast Hinterland, where the proportion of distressed listings has risen 5 per cent over the year to 11.7 per cent, and Southport, at 11.6 per cent.

In Sydney’s Fairfield, 10.8 per cent of listings are classed as distressed. Most of those affected were owner-occupiers and first-home buyers who were often on low wages, said Bassam Hendy of McGrath Estate Agents Liverpool.

“The average wage here is $50,000 to $70,000, which isn’t enough to pay a mortgage, and many are now looking for second jobs to help,” he said.

“I’ve got a friend who’s feeling the pinch of rising interest rates and prices big time, and he’s likely to turn into a client soon.

“Most of the people suffering bought in the last two years and they really don’t want to sell because the rental situation is so bad, but some don’t have a choice.”

The place most affected in Western Australia is West Pilbara with 10.1 per cent distressed listings. In Victoria, it’s Casey South with 4.6 per cent, in South Australia it’s Charles Sturt at 3.2 per cent, in Tasmania it’s Brighton at 2.8 per cent and, in the ACT, Belconnen at 2.3 per cent.

Sourced from Domain.com.au

in Latest News

Share This Post

Categories

Archived Posts

- February 2024 (1)

- January 2024 (2)

- October 2023 (2)

- September 2023 (1)

- August 2023 (3)

- July 2023 (2)

- September 2021 (1)

- August 2021 (3)

- November 2019 (1)

- October 2019 (4)

- February 2018 (1)

- January 2018 (1)

- December 2017 (3)

- November 2017 (1)

- October 2017 (2)

- September 2017 (4)

- August 2017 (4)

- July 2017 (2)

- June 2017 (1)

- May 2017 (1)

- April 2017 (1)

- March 2017 (1)

- February 2017 (1)

- January 2017 (2)

- December 2016 (2)

- November 2016 (1)

- September 2016 (1)

- July 2016 (1)