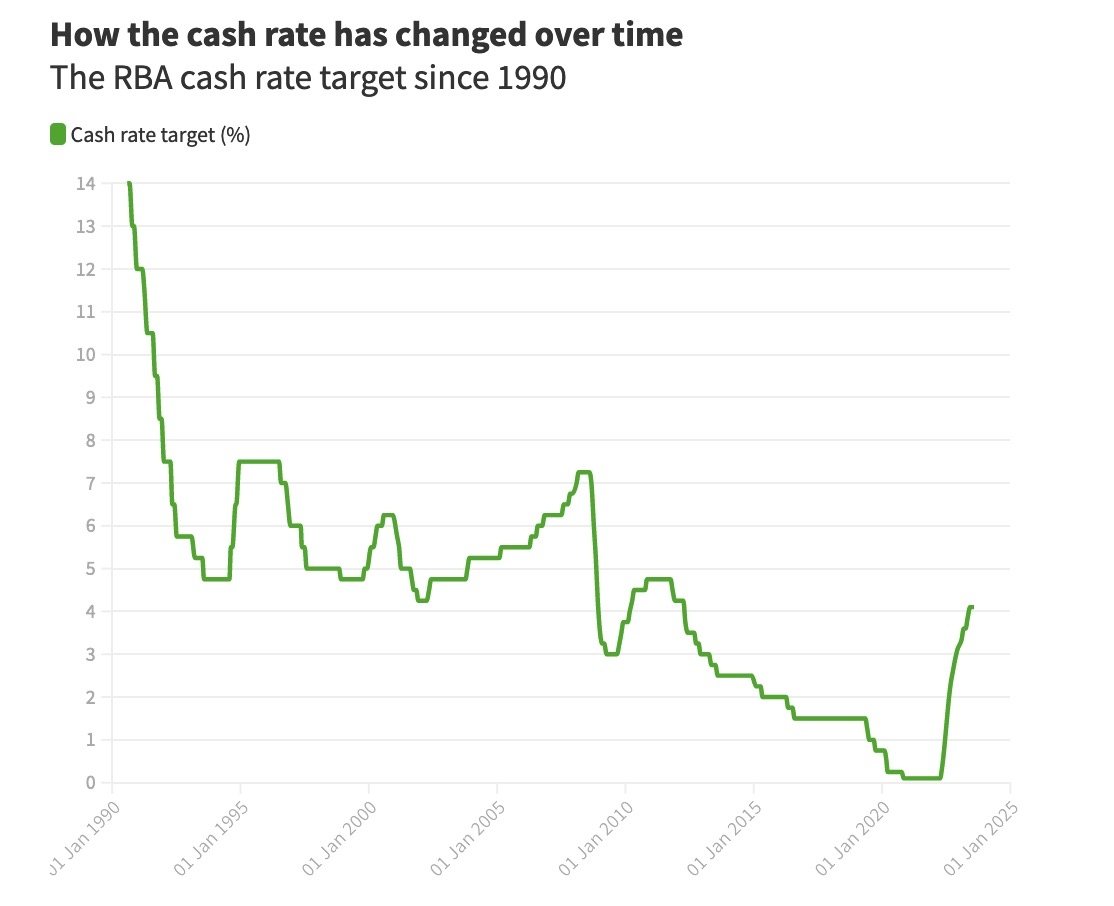

A second consecutive drop in annual inflation has convinced the Reserve Bank of Australia (RBA) to keep the cash rate on hold at 4.1 per cent.

It’s only the third pause to the interest rate cycle since May 2022, but will “give people much-needed relief,” according to one leading economist.

Ray White Group chief economist Nerida Conisbee welcomed the news and said it was likely the end of hikes was near.

“We do know that a lot of people are struggling with the cost of living at the moment, and people with mortgages are definitely feeling it given how fast interest rates have risen. It’ll also be good for the housing market in general because we do have a problem with housing supply, and higher interest rates aren’t helping the case of getting more construction happening,” she said.

Several economists have forecast one last hike before the peak of the interest rate cycle is finally reached.

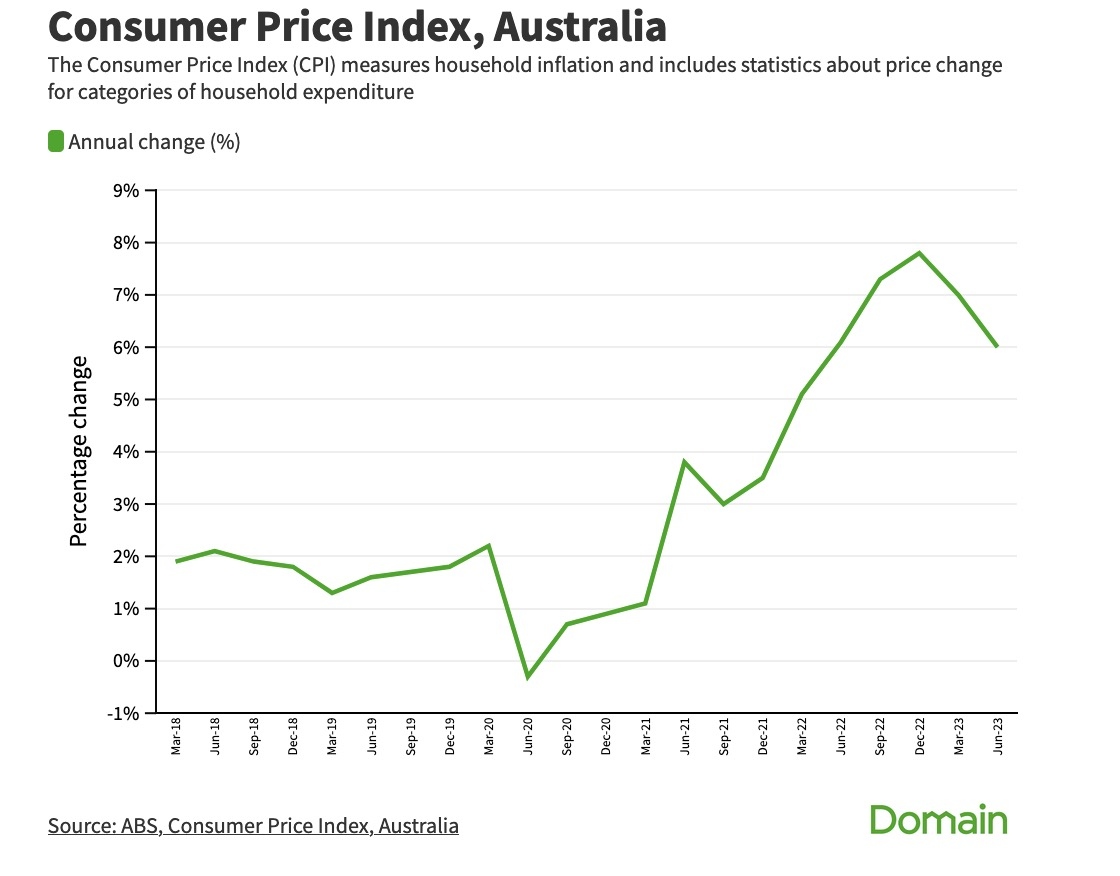

“Hopefully that’s it, because as we take a look at inflation it’s starting to come back. June quarter [rose by] 0.8 per cent, the lowest in almost two years,” said Conisbee.

He said some further tightening of monetary policy “may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks”.

Get the best property news and advice delivered straight to your inbox.

“In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market. The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

RMIT senior economics lecturer Dr Peyman Khezr says the RBA should have been increased rates by at least 0.1 percentage point.

“Inflation is going down but it’s still far from the target. Hence why I would increase a little bit, keeping it on hold is a bit risky,” he said.

“Mortgage holders might have got peace of mind in the short term [with a hold], but they will get affected by high inflation and they will be losing at the end of the day.”

While the consumer price index (CPI) rose by just 0.8 per cent this quarter – the lowest increase since September 2021 – annual inflation is still at 6 per cent, outside of the RBA’s target range.

The primary drivers for inflation this quarter were the increasing prices for services, fuelled by rent, travel and recreation spending.

“This is the first time since September 2021 that services inflation has been higher than goods, highlighting the change from 12 months ago when goods like new dwellings and automotive fuel were driving inflation. Now price increases for a range of services like rents, restaurant meals, childcare and insurance are keeping inflation high,” says Australian Bureau of Statistics head of prices statistics Michelle Marquardt.

Australians have been refinancing their mortgages at record levels since rates began rising last year and Domain Home Loans chief executive Kareene Koh said today’s decision to hold – for the second month in a row – would inject a solid dose of consumer confidence into the market.

“The rapid pace of the rises has certainly been a strain on anyone with a mortgage and that has a flow-on effect to the economy, impacting not only buyers and sellers and how they transact in the market, but also to tenants, who often have those extra mortgage costs passed on through raised rents,” she said.

“Some stability in interest rates will take some of that uncertainty out of the housing market and help give home owners and renters some clarity, as well as buyers and sellers the confidence to go forward in their decision-making.”

COMING OFF A FIXED RATE? WHAT YOUR NEW HOME LOAN REPAYMENTS COULD BE |

|||

| Loan amount | Monthly repayments on a fixed rate of 2% | New monthly repayments on a standard variable rate of 6.50% | Price difference per month |

| $500,000 | $1,848 | $3,160 | $1,312 |

| $600,000 | $2,218 | $3,792 | $1,574 |

| $800,000 | $2,957 | $5,057 | $2,100 |

| $1 million | $3,696 | $6,321 | $2,625 |

Source: Domain Home Loans calculator. Modelled on a fixed rate of 2% reverting to a variable rate of 6.5% and based on a loan term of 30 years, paying principal and interest

Koh said recent data from the Domain House Price Report, which found Australia’s housing recovery was well underway, was also likely to help with market confidence.

“The national house price median rose four times faster over the June quarter than in the first three months of this year. Property prices are recovering from the downturn and will likely to continue at a steady and manageable pace. There were people previously concerned that their loan-to-value ratio was being compromised by falling prices but we aren’t seeing that at the moment.”

Domain Home Loans, Credit Representative 500208 of Auscred Services Pty Ltd, Australian Credit Licence 442372.

Domain’s chief of research and economics Dr Nicola Powell said the recent bounce back in prices was already showing signs of stabilising as the supply of new properties listed for sale increased.

Sellers enticed by a price recovery were returning to the market, she said, and the evidence of new listings across the capital cities was rising.

“This could mark a potential stabilisation in house prices as more supply enters the market,” she said.

The latest new home lending data from the Australian Bureau of Statistics shows a rise in new mortgage activity from investors and owner-occupiers, reflecting the slowly growing market confidence, says Conisbee.

“There is a view now that interest rates are at a peak or very close and that’s put confidence into the housing market,” she said.

WHAT ARE YOUR MONTHLY HOME LOAN REPAYMENTS? |

||||

| Loan amount | 6.25% | 6.50% | 7% | 7.25% |

| $500,000 | $3,079 | $3,160 | $3,327 | $3,411 |

| $600,000 | $3,694 | $3,792 | $3,992 | $4,093 |

| $800,000 | $4,926 | $5,057 | $5,322 | $5,457 |

| $1 million | $6,157 | $6,321 | $6,653 | $6,822 |

“And then the other areas are things like construction costs are coming back; we are starting to see that travel will come back. There are a lot of positive signs on the horizon.”

But Peter Tulip, chief economist for the Centre For Independent Studies, believes inflation has not peaked yet and said he was worried the RBA had paused interest rates prematurely.

“I am disappointed. I think the Reserve Bank is making policies on wishful thinking. One quarterly data release is not super informative about the inflation outlook; there is quite a bit of noise in the quarterly numbers,” he said.

“The inflation expectations are not going to be falling, they’ve only got one way to go, which is up. There are a few downwards pressures and last week’s CPI came in lower than expected.

“I think when we do get some bad inflation numbers the RBA will react to them by raising rates and I think the likelihood of bad numbers is greater than the likelihood of good numbers over the rest of the year.”

Sourced from Domain.com.au

in Latest News

Share This Post

Categories

Archived Posts

- February 2024 (1)

- January 2024 (2)

- October 2023 (2)

- September 2023 (1)

- August 2023 (3)

- July 2023 (2)

- September 2021 (1)

- August 2021 (3)

- November 2019 (1)

- October 2019 (4)

- February 2018 (1)

- January 2018 (1)

- December 2017 (3)

- November 2017 (1)

- October 2017 (2)

- September 2017 (4)

- August 2017 (4)

- July 2017 (2)

- June 2017 (1)

- May 2017 (1)

- April 2017 (1)

- March 2017 (1)

- February 2017 (1)

- January 2017 (2)

- December 2016 (2)

- November 2016 (1)

- September 2016 (1)

- July 2016 (1)