Australia’s property market has almost fully recovered from the 2022 downturn, with new data revealing the national median house price is just $2000 shy of returning to pandemic boom highs.

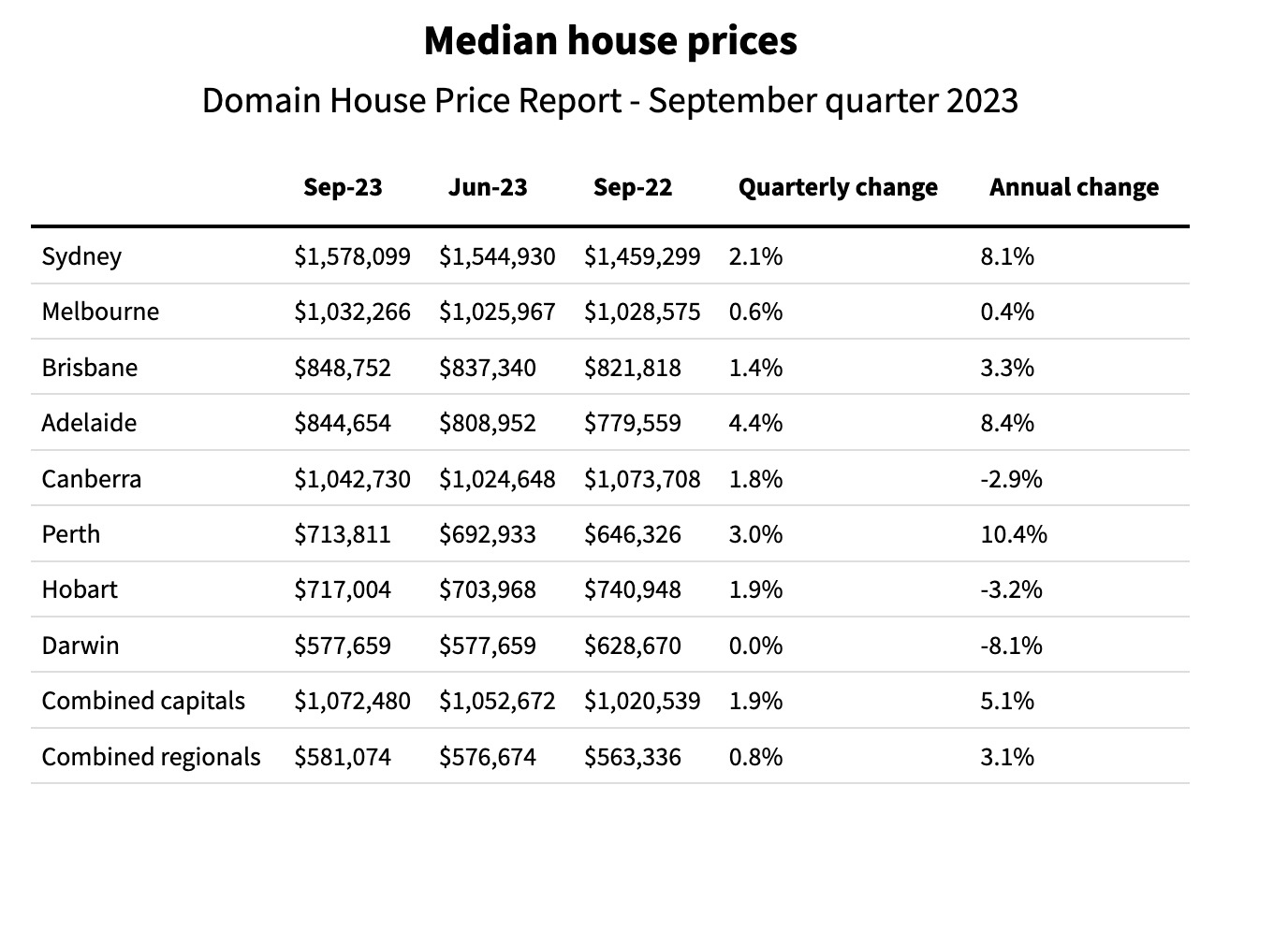

Domain’s latest House Price Report, released Thursday, shows every capital city is now in a state of recovery. Sydney and Brisbane are tipped to surpass their previous peak prices and hit new records by the end of the year.

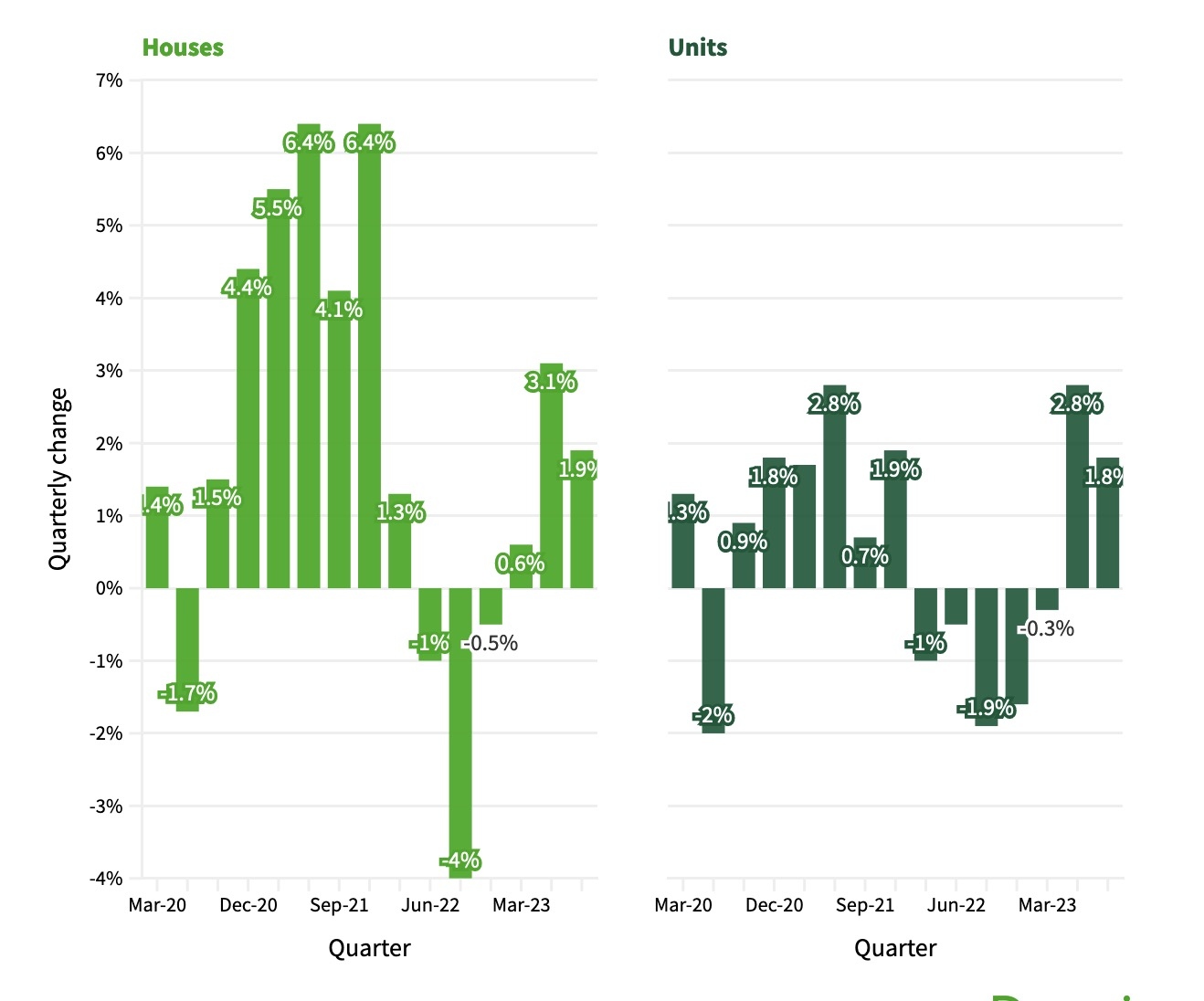

It is a stunning turnaround from last year’s short and sharp downturn, which saw Australia’s median house price record its steepest fall on record.

Sydney’s housing market incurred losses of $148,092 from the median price during the downturn; it has already recouped $135,705 of that. Brisbane lost $47,381 and has recouped $39,020, leaving a shortfall of just 1 per cent.

Over the September quarter this year, house prices have risen across every capital city.

“The pace of price growth is losing momentum,” she says. “We saw quite a strong start to the year in terms of price rise, but now we’ve started to see the pace of growth still be positive, but it moderated, and that is largely due to the increase in supply we’ve now started to see,” she says.

“New listings have improved, and September’s auction volumes reached a 16-month high. Nationally, total supply is now 5.1 per cent above July’s low (6.5 per cent higher across the combined capitals), although it remains lower annually compared to the five-year average.

“Listings rising is helping remove an element of urgency from some buyers.”

Sydney is still leading the recovery. Annually, Sydney house prices are up 8.1 per cent and units up 2.1 per cent.

Ric Serrao of Raine and Horne Double Bay says free-standing homes and the higher end of the market will push the Sydney median price to new levels.

“A free-standing house or a semi, I am finding that it’s not slowing down at all,” he says. “I definitely think anything that is renovated and free-standing or prestige…I think that will continue to grow.”

He attributed this price growth to the low supply in the market, high building costs and the difficulty of locking in a builder for new projects.

“I don’t know if any builders are doing fixed contracts at the moment, so there is just a lot of uncertainty for consumers in terms of what builders are actually going to cost,” he says.

Despite this uncertainty and low supply issues, both Serrao and Powell believe the Sydney market will have steady and normal growth moving forward.

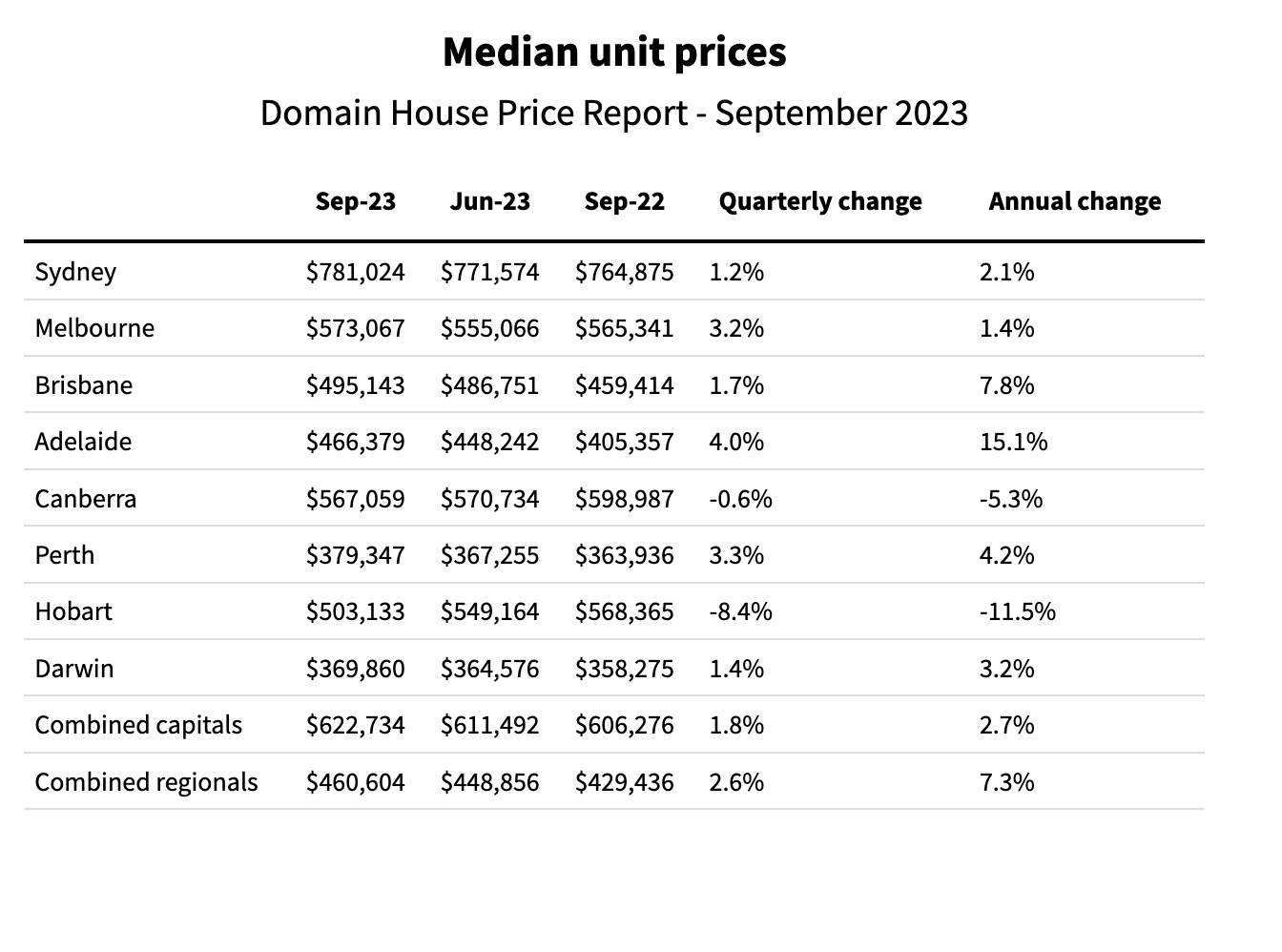

As well as rising house prices, Brisbane’s median unit price has reached a new record high.

“For the first time in the city’s history, unit prices have outperformed house prices for six consecutive quarters, narrowing the price gap between property types,” says Powell.

Judie O’Dea of Ray White Paddington says the price growth and recovery in Brisbane can be attributed to three things.

“Number one is that a lot of people who can’t afford houses are now able to afford a unit or a townhouse,” she says.

“Number two thing: it’s just population coming to Brisbane and seeking units, townhouses or homes. Those numbers are about 150,000 people coming across the border every year. It’s enormous.”

“Number three, the rents are so high that a lot of people have said, ‘bugger that, bugger paying rent, maybe I can go buy a unit or a townhouse’.”

O’Dea says the severe undersupply in the market has pushed prices up significantly, and she believes that it won’t be long before Brisbane hits new price records.

Perth and Adelaide hit new house price records for a second consecutive quarter, as well as recording the steepest quarterly gains for units.

“Adelaide has always been renowned as a quiet achiever, a title that the city defies as the state battles to balance positive net interstate migration, record levels of overseas migration, Australia’s tightest city rental market (joint with Perth) and a chronic undersupply,” says Powell.

Canberra has officially moved into recovery after house prices increased for the first time since mid-2022. So far, the median house price has recouped $18,000 of the $151,000 value lost during the downturn.

However, unit prices in Canberra declined once again into the September quarter.

“The conditions for Canberra were quite unusual. It was the steepest upswing, and the steepest downturn the market had ever seen,” she says.

Unlike Sydney and Melbourne, Canberra is not known to have big swings in its property cycle, and Powell believes the negative migration in Canberra was the cause behind the long downturn.

Overseas and interstate migration can affect a city’s property prices when supply cannot meet population growth, she says.

Powell says today’s property market is reminiscent of the 2010s market, where population was a mitigating factor while interest rates were rising.

“It happened back in 2010, where we had the cash rate rising, and we had the property prices rising. While it was very different economic circumstances between [2010 and today], there is one thing that unites them both, which is a strong level of population growth,” she says.

“It’s a timely reminder that the cash rate and the cost of debt is important, but it’s not the only thing that drives price cycles.”

Sourced from Domain.com.au

in Latest News

Share This Post

Categories

Archived Posts

- February 2024 (1)

- January 2024 (2)

- October 2023 (2)

- September 2023 (1)

- August 2023 (3)

- July 2023 (2)

- September 2021 (1)

- August 2021 (3)

- November 2019 (1)

- October 2019 (4)

- February 2018 (1)

- January 2018 (1)

- December 2017 (3)

- November 2017 (1)

- October 2017 (2)

- September 2017 (4)

- August 2017 (4)

- July 2017 (2)

- June 2017 (1)

- May 2017 (1)

- April 2017 (1)

- March 2017 (1)

- February 2017 (1)

- January 2017 (2)

- December 2016 (2)

- November 2016 (1)

- September 2016 (1)

- July 2016 (1)